Cardco Inc Has an Annual Accounting Period

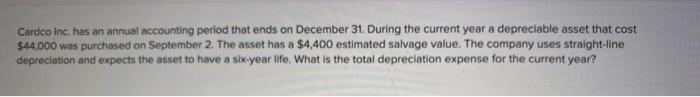

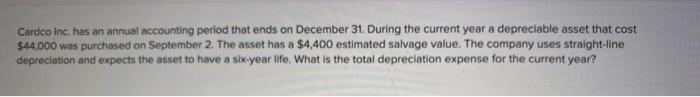

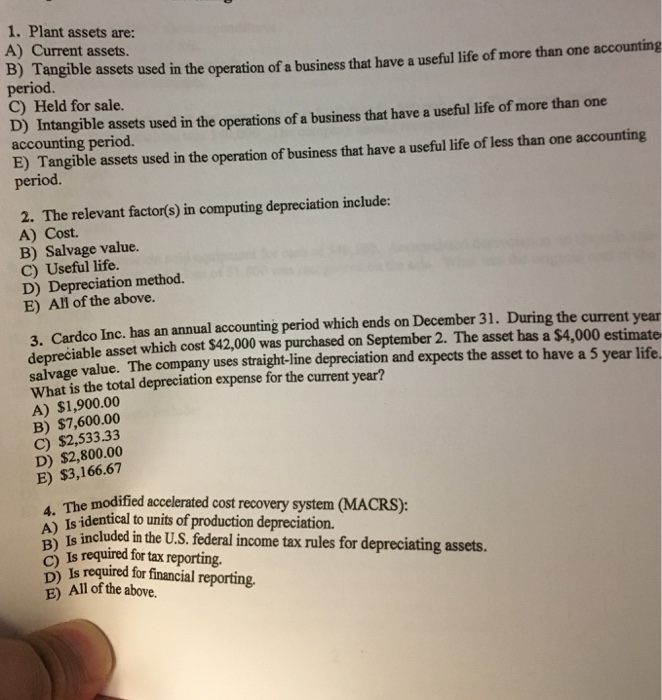

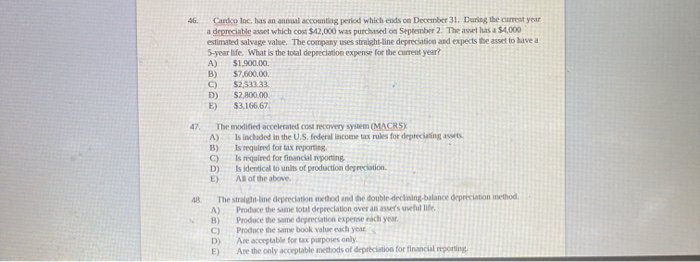

During the current year a depreciable asset thatcost 42000 was purchased on September 2. During the current year a depreciable asset which cost 42000 was purchased on September 2.

Solved A Machine Originally Had An Estimated Useful Life Of Chegg Com

What is the total.

. The company uses straight-line depreciation and expects the asset to have a 5 year life. Short Exam ACCT-101 Chapter 678 A company purchased a POS cash register on January 1 for 5400. Has an annual accounting period thatends on December 31.

Has an annual accounting period that ends on December 31. Has an annual accounting period which ends on December 31. 253333 A deposit in transit on last periods bank reconciliation is shown as a deoposit on the bank statement this period.

Has an annual accounting period that ends on December 31. During the current year a. During the current year a depreciable asset which cost 42000 was purchased on September 2.

What is the total. A Tangible assets used in the operation of a business that have a useful life of more than one accounting period. D Intangible assets used in the operations of a business that have a useful life of more than one accounting period.

The company uses straight-line depreciation and expects the asset to have a five-year life. During the current year a depreciable asset which cost 42000 was purchased on September 2. Has an annual accounting period that ends on December 31.

Has an annual accounting period which ends on December 31. The company uses straight-line depreciation and expects the asset to have a five-year life. The asset has a 4000 estimated salvage value.

The company uses straight-line depreciation and expects the asset to have a 5 year life. The company uses straight-line depreciation and expects the asset to have a 5 year life. Cardco Inc has an total annual accounting period which ends on Dec 31 During the from ACC 201 at University of Phoenix.

During the current year a depreciable asset which cost 42000 was purchased on September 2. The asset has a 4300 estimated salvage value. The asset has a 4000 estimated salvage value.

The asset has a 4000 estimated salvage. During the current year a depreciable asset that cost 42000 was purchased on September 2. Has an annual accounting period that ends on December 31.

Has an annual accounting period which ends on December 31. The company uses straight-line depreciation and expects the asset to have a five-year life. The asset has a 4000 estimated salvage value.

The company uses straight-line depreciation and expects the asset to have a 5 year life. During the current year a depreciable asset that cost 42000 was purchased on September 2. As a result in preparing this periods reconciliation the amount of this deposit should be.

C Held for sale. Has an annual accounting period that ends on December 31. The company uses straight-line depreciation and expects the asset to have a 5 year life.

The company uses straight-line depreciation and expects the asset to have a 5 year life. The company uses straight-line depreciation and expects the asset to have a five-year life. The company uses straight-line depreciation and expects the asset to have a five-year life.

During the current year a depreciable asset that cost 42000 was purchased on September 1. Has an annual accounting period that ends on December 31. Has an annual accounting period that ends on December 31.

Accounting questions and answers. The asset has a 4800 estimated salvage value. During the current year a depreciable asset that cost 42000 was purchased on September 2.

Has an annual accounting period that ends on December 31. During the current year a depreciable asset that cost 42000 was purchased on September 2. Has an annual accounting period which ends on December 31.

The asset has a 4000 estimated salvage value. The asset has a 4000 estimated salvage value. View short exam ACCT-101pdf from ACCT 101 at Saudi Electronic University.

During the current year a depreciable asset which cost 42000 was purchased on September 2. Has an annual accounting period which ends on December 31. The asset has a 4000 estimated salvage value.

The asset has a 4000 estimated salvage value. The asset has a 4000 estimated salvage value. Has an annual accounting period which ends on December 31.

Has an annual accounting period. The company uses straight-line depreciation and expects the asset to have a four-year life. During the current year a depreciable asset that cost 46000 was purchased on September 2.

During the current year a depreciable asset which cost 42000 was purchased on September 2. The company uses straight-line depreciation and expects the asset to have a 5 year life. During the current year a depreciable asset that cost 43500 was purchased on September 2.

Has an annual accounting period which ends on December 31. During the current year a depreciable asset that cost 41000 was purchased on September 2. The asset has a 4000 estimated salvage value.

The company uses straight-line depreciation and expects the asset to have a five-year life. The asset has a 4000 estimated salvage value. The asset has a 4000 estimated salvage value.

Depreciable asset which cost 42000 was purchased on September 2.

Cardco Inc Has An Annual Accounting Period That Ends On December 31 During The Current Year A Depreciable Asset That Cost 37 000 Was Purchased On September 2 The Asset Has A 3 000

Solved Plant Assets Are A Current Assets B Tangible Chegg Com

Solved 41 Plant Assets Are A Tangible Assets Used In The Chegg Com

No comments for "Cardco Inc Has an Annual Accounting Period"

Post a Comment